Accounting Worksheet is a very important work tool. It is not a formal tool that has to be maintained all the time but it makes complex calculation easy.

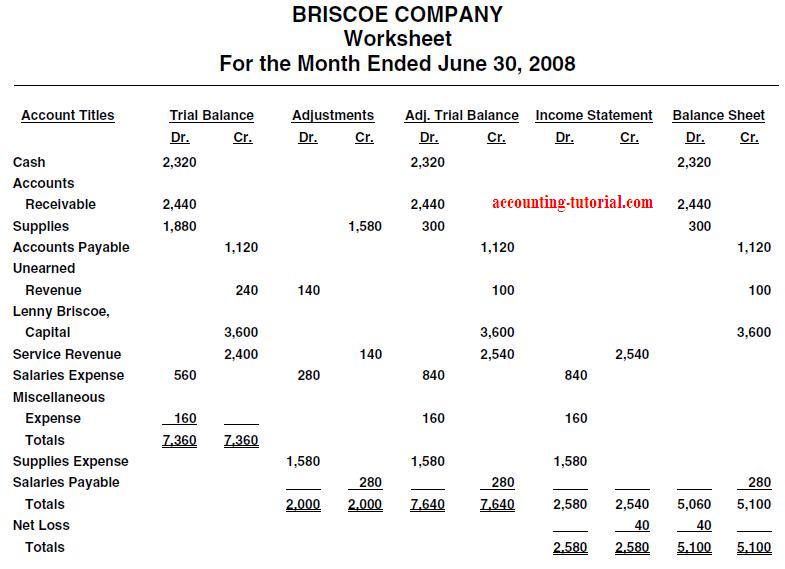

Companies use summarized data of statement. Accounting Worksheet is the way to summarize accounting information. Worksheet is a working material by which company can prepare financial statement and saves time. Basically worksheet is a document with 10 columns which transfers accounting data from trial balance to financial statement. Organization and accountants use worksheet to have financial statement of any company and accounting information in summarized manner.

Preparing an Accounting Worksheet:

Making of worksheet is not mandatory. However, if any organization entity need financial statement then making of worksheet is necessary. Suppose Independence Real Estate Co. use his financial statement. Then they have to create a work sheet from the trial balance and adjusting accounting data of this respective company. In order to create the worksheet some steps are required. Required steps are illustrated below:

- Place the unadjusted ending balance from the ledger accounts in the trial balance column of worksheet. Equal the debit and credit column of this trial balance.

- Enter the adjusting entry from adjustment that has been previously prepared as adjusted trial balance. Put only those entries, which are accruals or deferrals. Suppose unexpired prepaid insurance, accrued salaries, supplies that are on hand, transfers all these sorts of adjusting entries in the adjustment column of worksheet. Sum up the total amount of both debit and credit side.

- Transfers the adjusted balance in the adjusted trial balance by adjusting trial balance column and adjusted column. Suppose an accrued salary is 700 $. Now the salary in the trial balance is 2000 $ and 700 $ is a credit balance, then the adjusting balance will be 1300 $. This adjusted balance 1300 $ will be transferred in the adjusted trial balance column in the worksheet.

An account may have more than one adjustment entry. Suppose unearned service revenue can be adjusted with both service revenue and accounts receivable. Like the previous column this adjusted trial balance column should equals the debit and credit side.

Till now worksheet is only a document consists of balance which is come from ledger, adjusting entry. After completing trial balance, adjustment and adjusted trial balance, now it is the time to take further step regarding financial statement. Worksheet is created to prepare financial statement. Financial statement is related with income statement and balance sheet. Therefore, to prepare financial statement the worksheet needs elaborate the adjustment trial balance. For example:

- Enlarge the amounts of revenues and expenses accounts from adjusted trial balance to the income statement and amount of assets, liability and owner™s equity from adjusted trial balance to the balance sheet. The adjusted entries of debit and credit column remain same in the income statement and balance sheet that means (debit remains debit and credit remains credit.

- Net income or net loss finding is the required step in preparing financial statements. Income statement figures net income or net loss. After transferring all entries in the income, statement sums up the total amount of both sides. If credit exceeds debit column it will be net income or reversely if debit exceeds credit column it will be net loss. Enter net income in the debit side of income statement and credit side of the balance sheet, oppositely enter net loss credit side of the income statement and debit side of the balance sheet. Total the balance sheet. Equality of debit and credit column proves an appropriate work sheet.

Leave a Reply